Cryptocurrency mining is not just a buzzword; it’s a gateway to financial freedom for many. If you’re ready to dive into this dynamic world, you’re in the right place. Understanding the secrets to profitable cryptocurrency mining can transform your journey from a mere interest into a lucrative venture.

What is Cryptocurrency Mining?

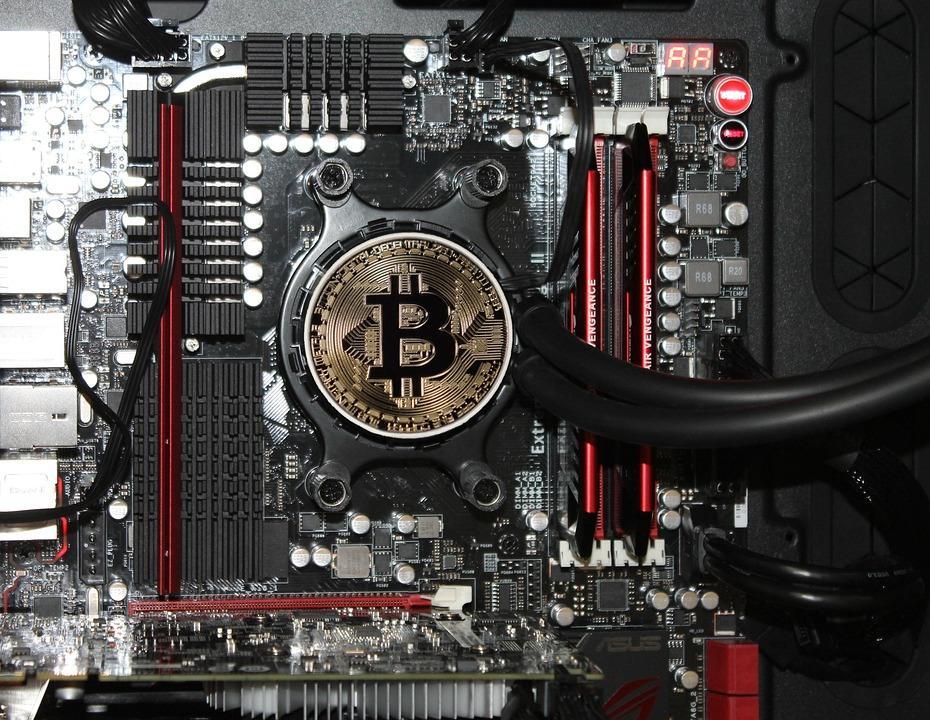

At its core, cryptocurrency mining is the process of validating transactions on a blockchain network. Miners leverage powerful computers to solve complex mathematical puzzles, ensuring that transactions are secure and legitimate. When successful, miners are rewarded with cryptocurrency, making this both an exciting and potentially profitable endeavor.

Why does this matter to you? Because as the crypto landscape continues to evolve, understanding the nuances of mining can put you ahead of the curve. It may just be the opportunity you’ve been waiting for.

The Growing Importance of Cryptocurrency Mining

In recent years, cryptocurrency has moved from the fringes of finance to mainstream acceptance. Institutions are investing, and everyday people are jumping into the fray. This boom means that mining offers not just the thrill of tech-savvy engagement but also the potential for substantial returns.

However, diving in without knowledge is a recipe for disaster. Let’s unveil the seven secrets that will guide you towards profitable cryptocurrency mining.

Secret #1: Choose the Right Cryptocurrency

Not all cryptocurrencies are created equal, and your choice can make or break your mining success.

- Bitcoin: The most well-known, but requires substantial investment in hardware.

- Ethereum: While it’s transitioning to Proof of Stake, there are still opportunities in its current Proof of Work model.

- Altcoins: Smaller cryptocurrencies often have lower competition and can yield higher returns.

Research is key. Tools like CoinMarketCap or CoinGecko can help you assess which cryptocurrencies are climbing and which are falling.

Secret #2: Invest in Quality Hardware

Your mining rig is your lifeline. Cheap hardware may seem enticing, but it can lead to inefficiencies and wasted energy.

- ASIC Miners: These are specifically designed for certain cryptocurrencies, like Bitcoin.

- GPUs: Flexible for mining various altcoins but can be less efficient than ASICs for Bitcoin.

Make sure to keep an eye on market trends and hardware reviews. Websites like Tom’s Hardware and TechRadar can provide insights on the best mining setups available.

Secret #3: Calculate Your Costs

Before you start mining, you need to understand your expenses. This includes:

- Electricity: Mining is energy-intensive. Calculate costs based on your local rates and the energy consumption of your rig.

- Cooling: Overheating can damage your equipment. Factor in the cost of fans or air conditioning.

- Pool Fees: If you join a mining pool, they typically charge a fee, usually a percentage of your earnings.

Using mining profitability calculators like WhatToMine can give you a clearer picture of potential returns versus costs.

Secret #4: Join a Mining Pool

Going solo can be appealing, but mining pools can significantly boost your chances of success.

- Consistent Payouts: Pools combine the hashing power of multiple miners, which increases the likelihood of solving blocks and earning rewards.

- Lower Variance: Instead of waiting for a long time to earn, pools provide more frequent payouts.

Some reputable mining pools include Slush Pool and F2Pool. Always do your research to ensure they’re trustworthy.

Secret #5: Stay Updated on Regulations

Cryptocurrency regulations can change rapidly, impacting your mining operations and profitability.

- Local Laws: Understand the laws in your jurisdiction regarding crypto mining. Some areas offer tax incentives, while others may impose strict regulations.

- Tax Implications: Earnings from mining are often considered income. Consult a financial advisor or tax professional to ensure compliance.

Resources like the IRS guidelines on cryptocurrency can help clarify your responsibilities.

Secret #6: Monitor Market Trends

The crypto market is notoriously volatile. Staying informed can help you make smarter decisions.

- Price Movements: Use apps like Blockfolio or CoinMarketCap to track price changes and market sentiment.

- News: Follow reputable sources like Coindesk or The Block to stay ahead of the game.

Being proactive can mean the difference between profit and loss.

Secret #7: Optimize Your Mining Strategy

Finally, it’s essential to refine your approach continually:

- Experiment with Different Coins: Don’t be afraid to switch it up. What’s profitable today might not be tomorrow.

- Fine-Tune Settings: Adjust your hardware settings for maximum efficiency.

- Stay Engaged with the Community: Join forums or social media groups to share experiences and gather insights.

Finding your niche within the mining community can provide valuable tips and support.

Bottom Line

Cryptocurrency mining can be a rewarding venture, but it requires a strategic approach. By understanding the secrets to profitable cryptocurrency mining, you’re setting yourself up for success.

So, whether you’re just starting out or looking to optimize your current setup, remember: Knowledge is power. Dive deep, stay informed, and let your mining journey begin!

FAQ Section

Q: Is cryptocurrency mining still profitable in 2025?

A: Yes, if you choose the right coin, hardware, and location, mining can still be profitable.

Q: What are the best cryptocurrencies to mine in 2025?

A: It depends on market trends, but altcoins like Ethereum Classic and Ravencoin are worth considering.

Q: How much electricity does crypto mining consume?

A: It varies by hardware, but expect significant consumption. Always calculate costs based on your local rates.

With these insights, you are now equipped to embark on your cryptocurrency mining journey with confidence. Let’s get mining!